Simplifying Crypto Taxes, Maximizing Your Savings

Crypto taxes shouldn’t be a guessing game. Our expert team ensures your tax filings are accurate, compliant, and optimized so you keep more of what you earn.

- Minimize your tax bill

- Eliminate compliance risks

- Save time and stress

Traditional Accountants Don’t Speak Crypto We Do

Crypto taxation is complex and ever changing and most Accountant CPAs aren’t prepared for it. We specialize in digital asset tax strategies, ensuring accuracy where generic tax software and traditional firms fall short.

Let us handle your crypto taxes with expertise, precision, and confidence.

Crypto Tax Software We Work With

We integrate seamlessly with leading crypto tax software to ensure accurate calculations and reporting.

Who We Help

We work with individuals, businesses, and institutions in the crypto space, ensuring compliance and maximum tax savings.

Crypto Investors & Traders

Whether you trade daily or hold long-term, we help calculate accurate gains and losses

Web3 Entrepreneurs & NFT Creators

From NFT projects to blockchain startups, we provide financial clarity and tax solutions

Crypto Miners & Stakers

We track mining and staking rewards to ensure proper tax reporting and compliance.

DeFi & Yield Farming Participants

We handle complex DeFi transactions, including liquidity pools and interest-bearing crypto.

DAOs & Crypto Businesses

Structured tax solutions for decentralized organizations, crypto companies, and blockchain-based ventures.

High-Net-Worth & Institutional Clients

Tailored tax planning for large portfolios, hedge funds, and institutional crypto investors.

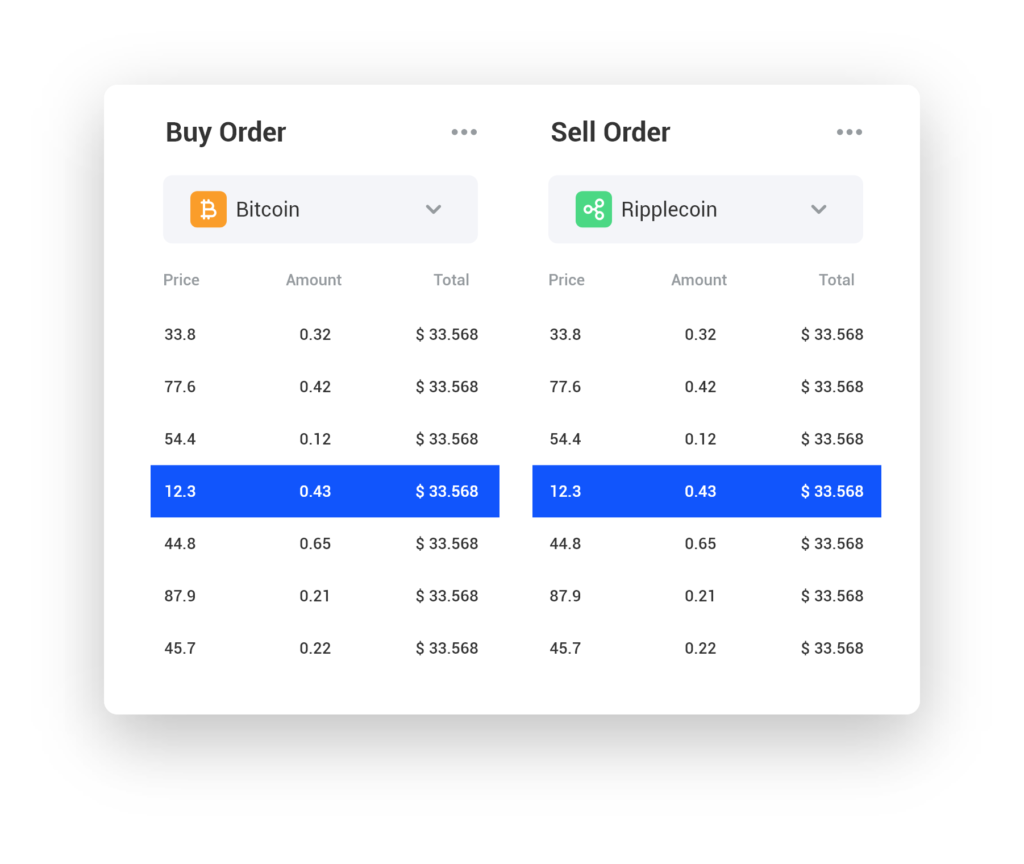

Your Crypto Tax Software

Could Be Costing You Thousands

Many crypto tax calculators overestimate capital gains by up to 90%, leading to unnecessary tax payments and compliance risks.

Comprehensive Crypto Tax & Accounting Services

Our team of crypto tax specialists helps businesses and individuals navigate the financial complexities of digital assets, DeFi, and Web3.

Crypto Tax

Reporting

We bring clarity and structure to your crypto transactions with expert bookkeeping and compliance strategies.

Crypto Business & NFT Bookkeeping

From NFT projects to DeFi platforms, we provide specialized financial tracking for crypto-based businesses.

Strategic Tax Planning & Compliance

We develop personalized tax strategies to reduce liabilities and ensure full compliance with evolving regulations.

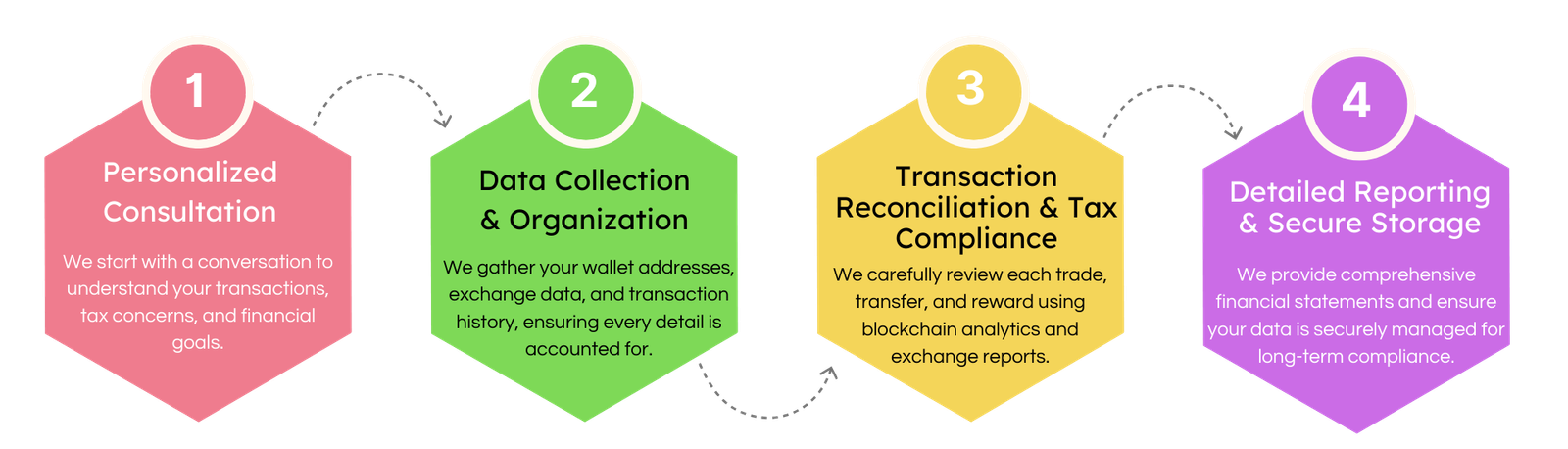

Our Step by Step Crypto Tax Process

We’re Crypto Experts

Not Just Accountants

We’re more than tax professionals—we’re crypto natives who understand the industry inside and out. Our team includes:

- Certified tax professionals specializing in crypto and Web3 taxation

- Experienced traders and data analysts ensuring transaction accuracy

- Regulatory experts keeping you compliant with evolving tax laws

FAQs: Everything You Need to Know About Crypto Taxes

Yes, in most countries, crypto is considered taxable property. Transactions like trading, selling, earning staking rewards, or mining are taxable events.

Failure to report crypto transactions can lead to fines, audits, and potential legal consequences. Tax authorities are increasingly tracking crypto transactions through exchanges and blockchain records.

Yes! If you’ve sold crypto at a loss, you may be able to offset gains and reduce your overall tax liability. We help you strategize for tax loss harvesting to maximize your savings.

We reconcile all your crypto transactions using exchange data, blockchain records, and crypto tax software to ensure accurate reporting and full compliance.

Most crypto tax software relies on automated calculations, which often overestimate gains, miss transaction details, or fail to apply correct tax treatments. We manually review transactions to ensure accuracy.

Yes! We specialize in DeFi, NFT, and Web3 tax solutions, including staking, yield farming, and NFT sales.

We offer tax optimization strategies, including tax-loss harvesting, entity structuring, and deduction maximization, to minimize your tax bill while staying fully compliant.

We cross-check transactions from multiple exchanges, wallets, and blockchains, ensuring complete and precise tax reporting that minimizes overpayments and maximizes deductions.

Yes! We specialize in global crypto tax compliance and work with clients worldwide to ensure they meet jurisdiction-specific tax laws.

It’s simple! Book a free consultation, provide your transaction data, and let our experts handle everything. We’ll deliver accurate, compliant, and tax-optimized reports tailored to your needs.

Let’s Get Your Crypto Taxes Right—The First Time

Tax season doesn’t have to be stressful. With Tax My Crypto, you’ll have expert guidance, accurate calculations, and a tax strategy designed to save you money.